Credit with BILL has all the perks and benefits you’d expect from a robust business credit line. From features to rewards, you’ll love having credit with BILL.

No annual fees

Flexible rewards

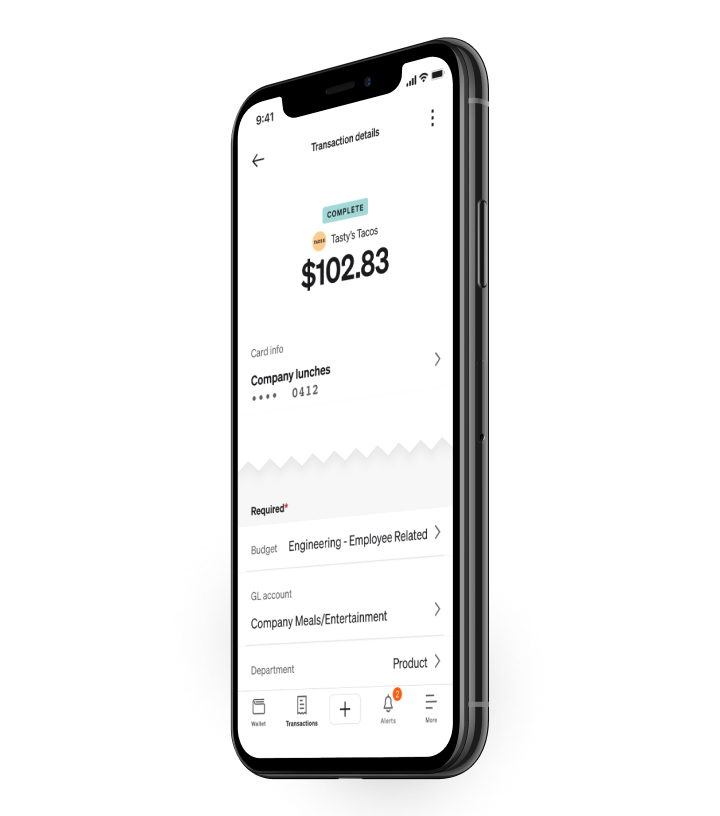

Seamless, automatic expense management with BILL Spend & Expense software

Access to virtual cards for greater control of your online purchases and subscriptions

Each employee gets a card that can be controlled by your admin

Set budgets to control spend

Annual & monthly fees

Set rewards

Used in combination with other software like Expensify, Concur, Excel, paper expense management, etc.

Some allow for virtual cards

Limited number of cards per organization

No spending locks or tracking

That’s right. BILL’s world-class expense management software is free.