Product

Accounts Payable & Receivable Features

Streamline how you pay and get paid

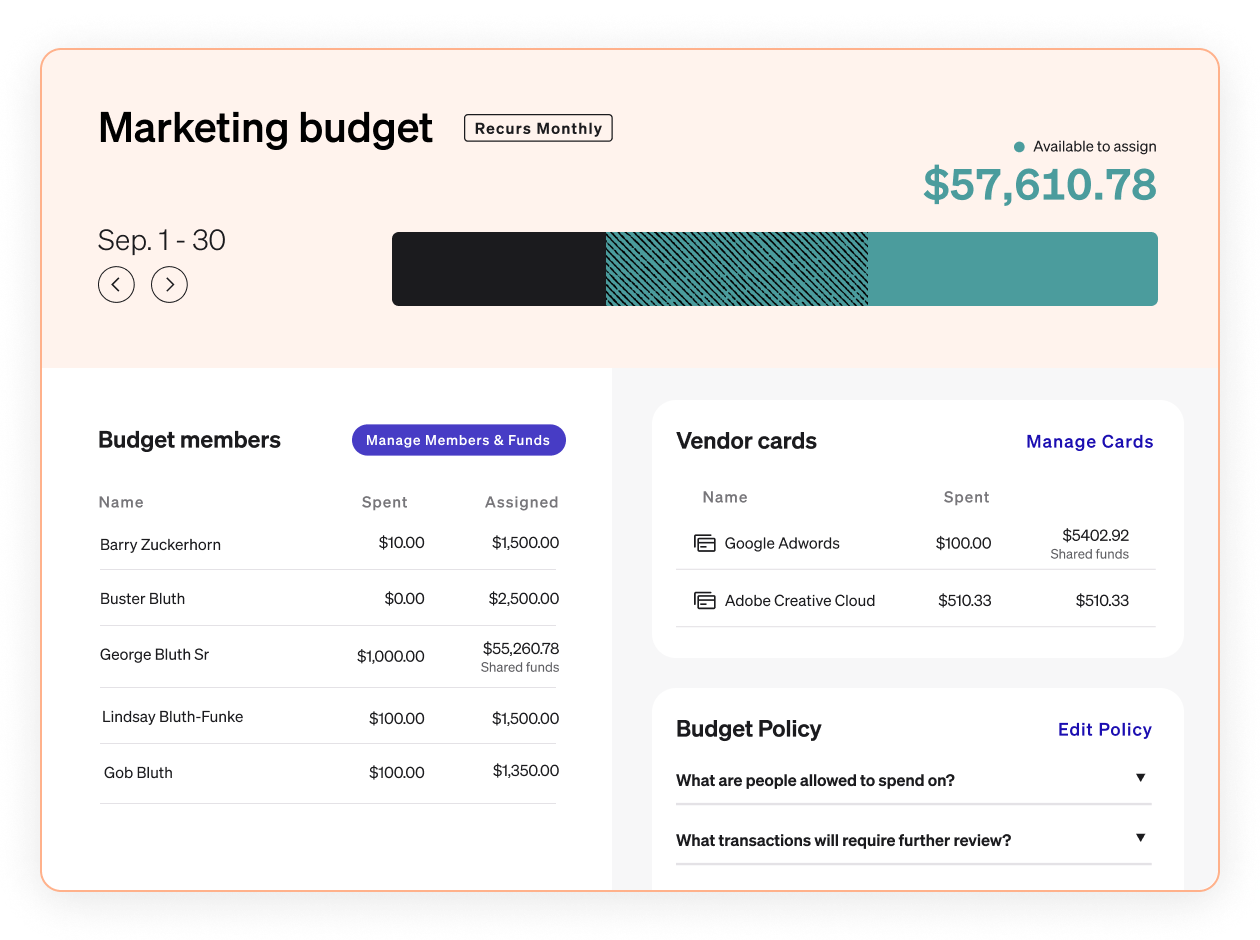

Spend & Expense Features

Get credit, control budgets, manage spend

Learn how you can simplify your bills.

Solutions

Small Businesses

Easily manage & automate your processes

Midsize Companies

Scale your finance operations efficiently

By Industry

Millions of businesses and accounting firms trust BILL.

Resources

Resource Center

Explore events, guides, and downloadable tools related to your topics of interest

Blog

Stay up-to-date with the latest articles to improve your financial operations.

Customer Stories

Discover why millions of businesses and top accounting firms use BILL

Learn & Connect

Recently Featured

No items found.

Company

Press Releases

Official communications from BILL

Investor Relations

Information and resources for investors

Careers

We're Hiring!

Careers overview and current job openings

BILL is making the financial back office a better place.

.png)

.png)