One of the essential duties of a business owner is to ensure that you’re always on stable ground — but to do that, you need to know which metrics to look at. The quick ratio (sometimes called the acid test ratio) is one of the most helpful ways to measure your financial health because it can show whether you can pay your short-term liabilities with its most liquid assets. Here’s what you need to know about the quick ratio and how to use it for your business.

What is the acid test ratio?

The acid test ratio is a liquidity ratio that reflects a company’s ability to pay its short-term liabilities with its liquid assets. You’d use your balance sheet’s current assets and liabilities to calculate the quick ratio.

This ratio is similar to the current ratio, which is the ratio of current assets to current liabilities. But there’s an important distinction: Unlike the current ratio, the quick ratio formula only looks at your most liquid current assets — accounts receivable, cash, and cash equivalents.

So, essentially, it’s a more rigorous version of the current ratio. And that rigor is why it’s so useful.

Why the quick ratio is important

You should use the acid test ratio because it gives you a conservative picture of your liquidity position. Only relying on other liquidity ratios can inflate your financial health and give you the wrong picture. But if you analyze multiple liquidity ratios (like the current ratio formula), you’ll create a more clearly defined picture of your business’s position and can make better informed financial decisions.

What the acid test ratio says about your business

Because you’re only factoring in liquid assets — current assets that can be converted into cash within 90 days with a high degree of certainty — the quick ratio shows you what you could draw upon if you had to pay all your liabilities.

You’re in good shape if you have more liquid assets than liabilities. But you could be in financial danger if your current liabilities trump your liquid assets.

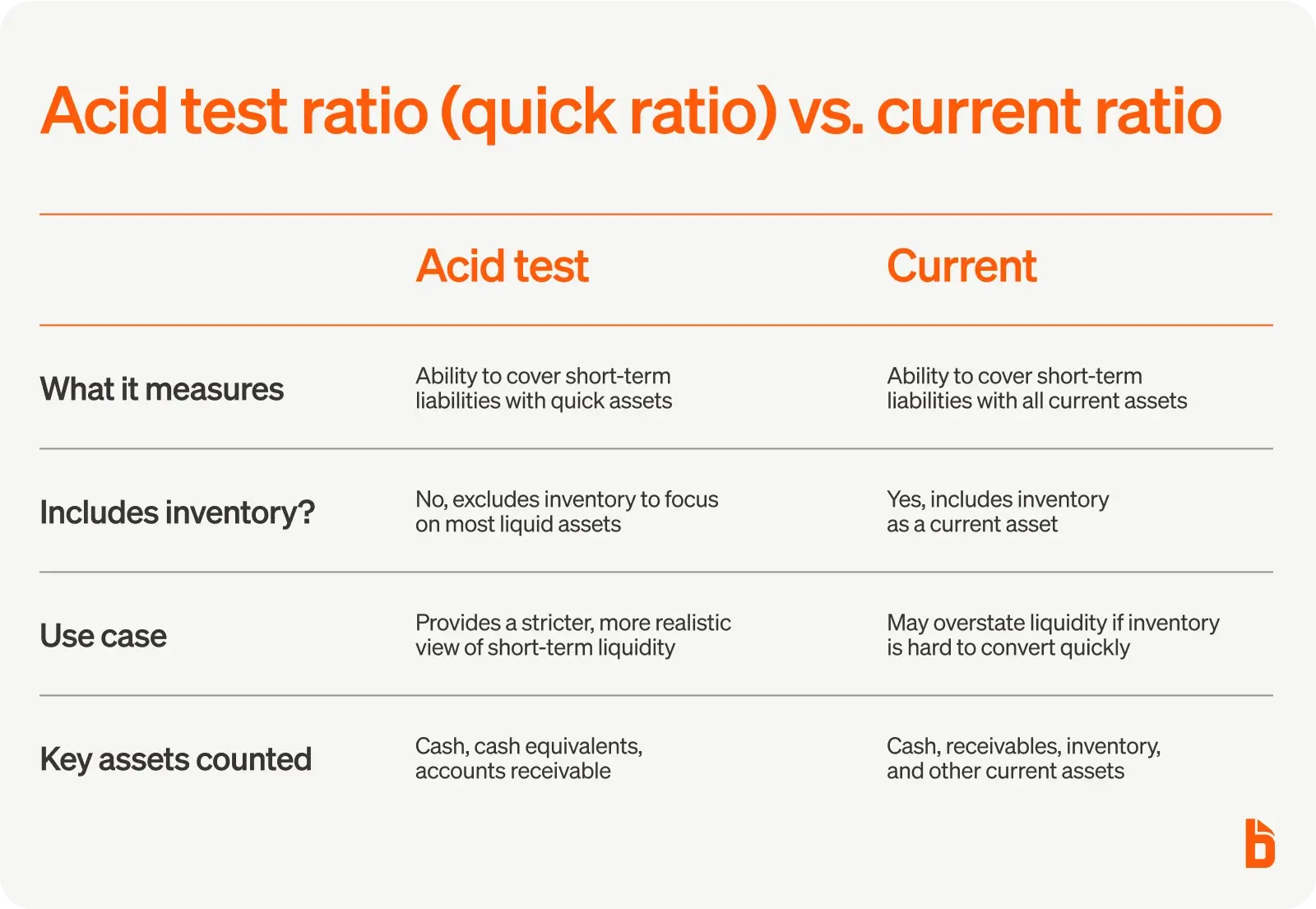

Acid test ratio vs. current ratio

The critical difference between the acid test ratio formula and the current ratio formula is that inventory isn’t generally included in the acid test. You’re focusing on only quick assets, which is why it’s called the quick ratio.

For most businesses, inventory can take months or years to turn over. So, when you include inventory in the current ratio, you’re not getting a true reflection of your financial stability.

If you can’t sell your inventory in a couple of months, these assets won’t improve your liquidity position in the short term. As a result, you could have a good current ratio but struggle to meet your short-term obligations.

An example of quick ratio vs. current ratio

Let’s take a bookstore as an example. Beverly’s Books has a lot of assets tied up in inventory, which will increase the current ratio.

In the first quarter of 2023, Beverly’s Books had $700,000 in current assets and $500,000 in current liabilities. Here’s what this would look like using the current ratio formula:

Current Ratio = Current Assets / Current Liabilities

1.4 = 700,000 / 500,000

It looks like Beverly’s Books is in a good position because the current ratio is 1.4

However, the company doesn’t have a lot of cash and cash equivalents or outstanding invoices. If you take the inventory out of the current assets, Beverly’s Books only has $400,000 in quick assets.

Using the quick ratio, we see that would bring the ratio down to 0.8:

0.8 = 700,000 - 300,000 / 500,000

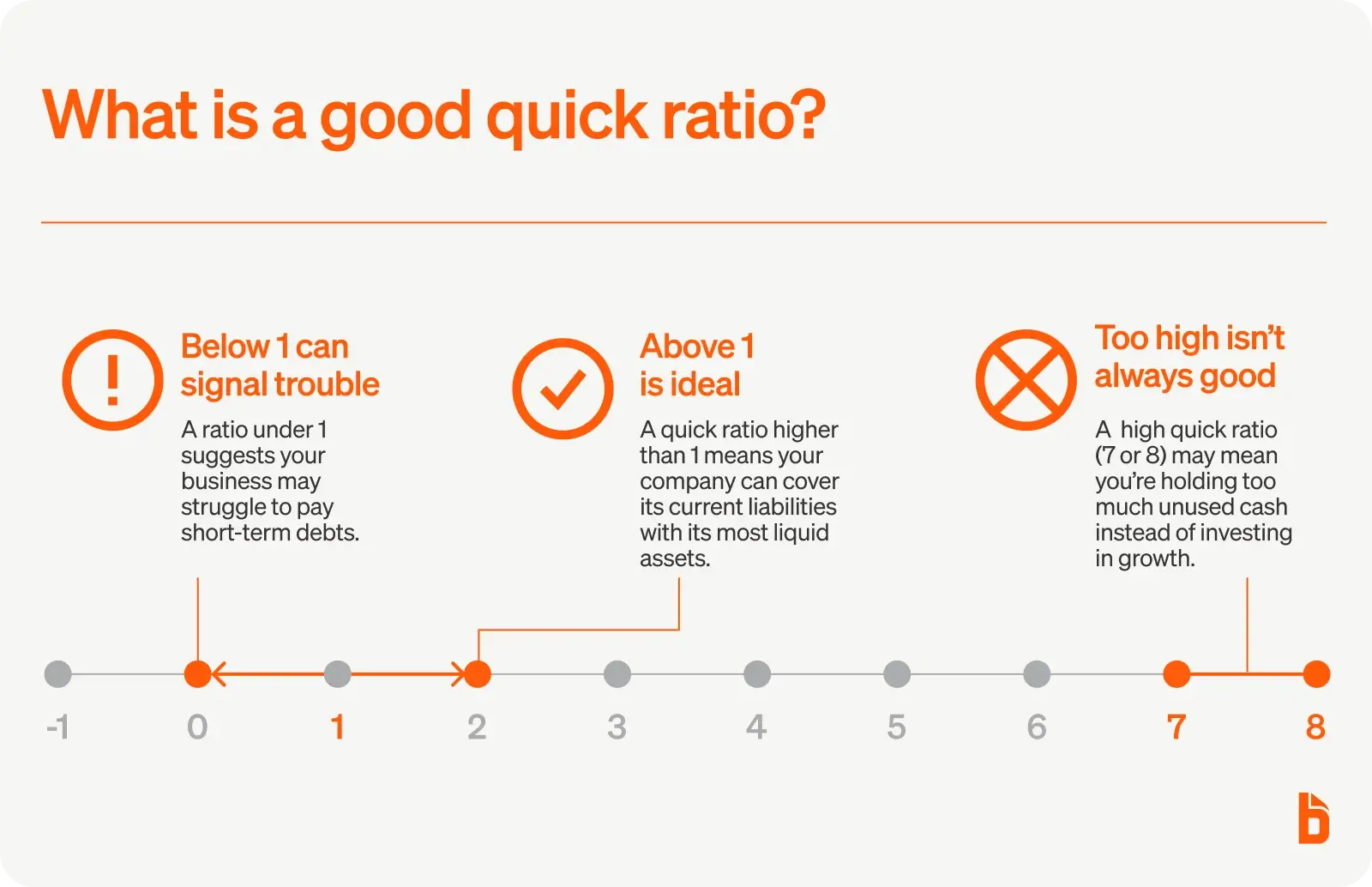

What is a good quick ratio?

A good quick ratio is above 1. If the ratio is below 1, a company might have trouble paying its current liabilities. However, there is such thing as too high of a quick ratio: A very high ratio of 7 or 8, for example, can imply that cash is unused that could be used to generate company growth or investments.

The quick ratio formula

The quick ratio or acid test ratio formula is all about finding your liquid assets, which is done by subtracting your inventory and prepaids from your current assets. So while inventory typically falls under current assets, you need to separate them for this formula because we’re only interested in your most liquid assets, like cash.

Here’s the acid test ratio formula:

Quick Ratio (Acid Test) = Current Assets - Inventory - Prepaid Expenses / Current Liabilities

Because current assets minus inventory and prepaid expenses are your liquid assets, the formula can also be read as follows:

Quick Ratio (Acid Test) = Liquid Assets / Current Liabilities

But not every business will use the same quick ratio formula — it depends on what you can convert to cash quickly.

For example, if a construction company takes six months or more to complete a project, it might not expect invoices to be paid for more than 90 days, so that it wouldn’t look at accounts receivable. On the other hand, a coffee shop might include its inventory in its current assets because it knows it will turn over its coffee and baked goods — meaning its inventory can be converted to cash within 90 days.

Take charge of your expenses with BILL

Part of making any plans for your business is knowing where your expenses and accounts payable are at right now. With BILL's automated AP platform, you can have the answers you need at your fingertips, and make financial decisions with confidence. Learn more here.