According to a study from Indiana University, roughly 60% of accounting errors come from basic bookkeeping mistakes. You can prevent many of these mistakes by relying on a trial balance to keep track of your financial transactions.

What is a trial balance? And how do you prepare a trial balance report? A thorough understanding of these documents can reduce your error rate — not to mention your stress levels.

What is a trial balance?

A trial balance is a report summarizing all account balances on a general ledger at a specific point in time, summing up the debits and credits to ensure they’re balanced.

Debits and credits are a part of double-entry accounting practices where every transaction has two parts that must be equal.

By verifying the total debits equal total credits and are balanced, you are verifying that every dollar is accounted for and there were no mathematical errors when recording transactions.

Creating a trial balance is typically done at the end of a reporting period, before the preparation of formal financial statements (income statement and balance sheet). If the trial balance fishes out any errors, they’ll be fixed before they transfer over to any financial reports.

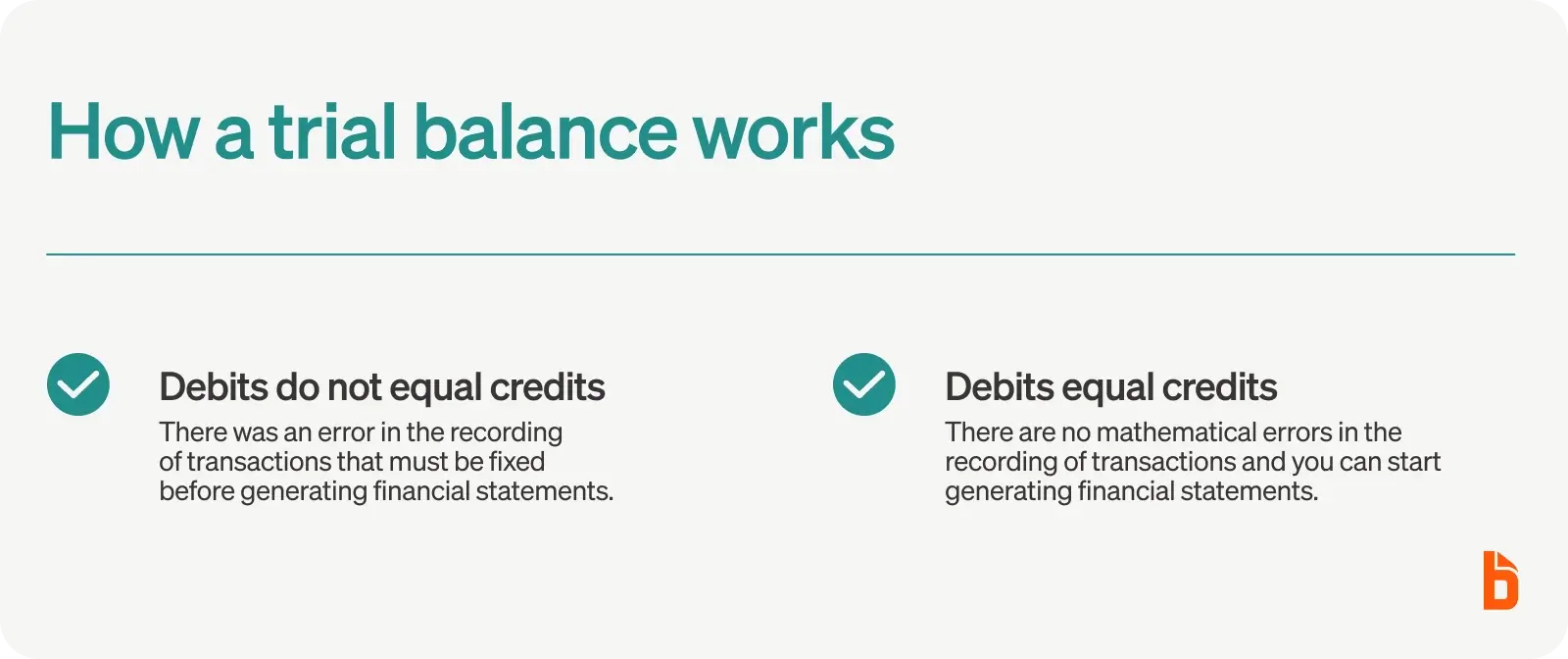

How does a trial balance work?

In a double-entry accounting system, you record your debits and credits in separate columns on your general ledger. For instance, you register a transaction when it occurs, then record the same transaction once you receive payment. All the ledger accounts must balance to zero.

The trial balance simply records all of the transactions listed in your general ledger accounts on a separate spreadsheet so you can ensure that your journal entries are balanced and accurate.

If they are not, your trial balance shows that something is wrong with your books, allowing you the chance to fix them, guaranteeing financial accuracy.

What does a trial balance include?

A trial balance includes all your business account balances that have credits or debits during a given reporting period. It includes the amounts credited or debited to each account, the dates of the reporting period, the account numbers, and the totals for all credits and debits entered during that time.

Trial balances vary depending on your business, but may include:

- Income

- Assets

- Liabilities and expenses

- Accounts receivable

- Accounts payable

- Gains

- Losses

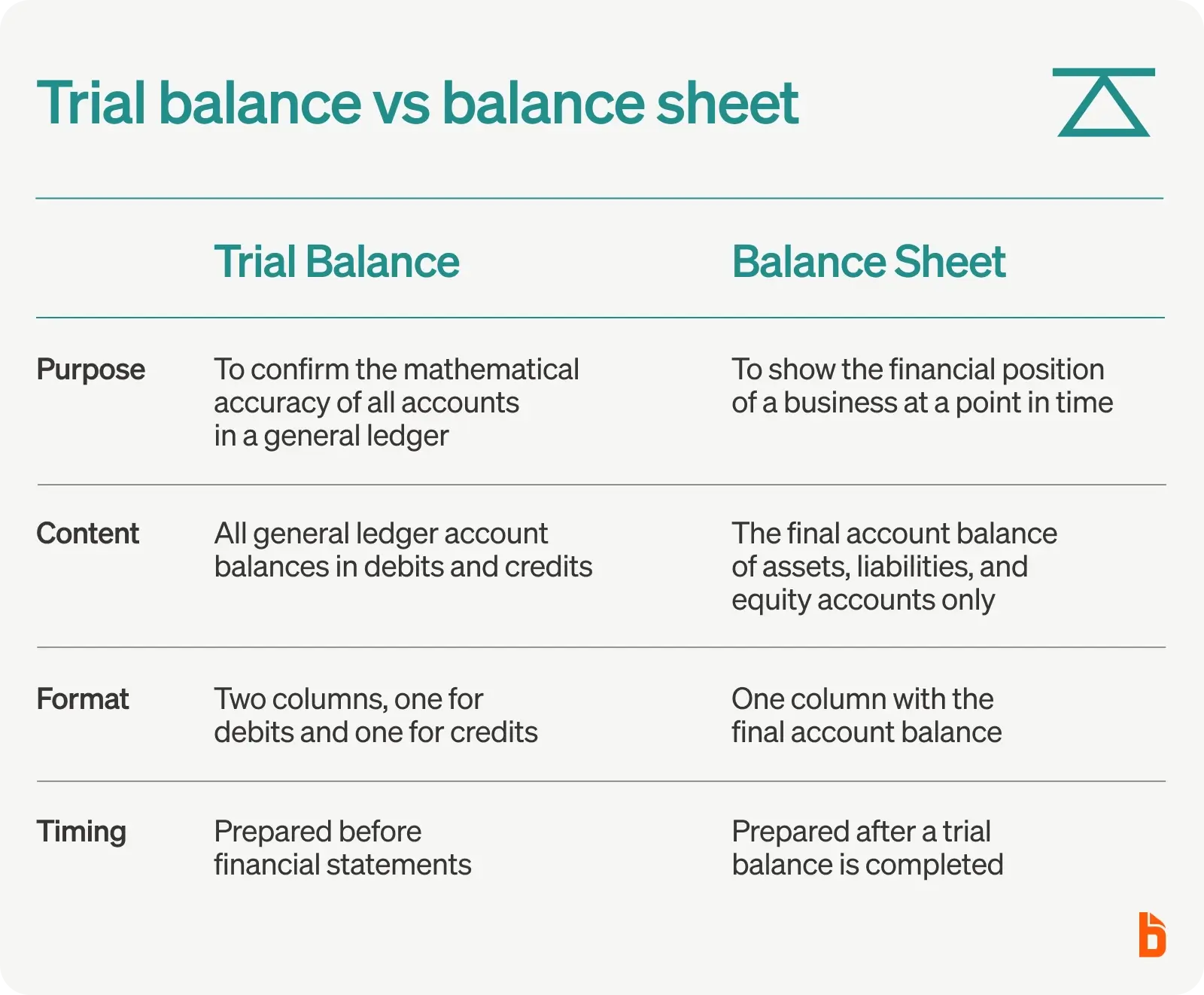

What is the difference between a trial balance and a balance sheet?

A trial balance should not be confused with an actual balance sheet.

Trial balances are created as a “trial” of all recorded bookkeeping transactions in a given accounting period, before the information is translated into other financial statements, like a balance sheet. They are solely used for internal management purposes.

A balance sheet should be prepared annually and distributed to investors or relevant financial institutions. And while a trial balance is prepared purely for your internal controls, a balance sheet is required to manage your company's finances.

How often should businesses create trial balances?

You should try to create a trial balance at least once every reporting period. This ensures that your books are correct and that you can withstand a financial audit.

In addition, any time you suspect an error in your books, you should quickly put together a trial balance to check that your debits and credits are correctly balanced.

Who uses a trial balance?

Accounting and bookkeeping professionals might use a trial balance to perform an internal audit of the company's finances. While modern accounting software can minimize data entry errors, mathematical errors and similar mistakes, trial balances still have their uses among internal company leadership and small business owners.

For example, senior management may appreciate regular trial balance reports, as they put the company's most important information in one place. Similarly, accounting teams might use trial balances when performing periodic reviews or when an error is suspected.

Trial balance format

While there are no formal requirements for a trial balance, it typically consists of at least three columns. The first column on the far left will include the names of each account listed on your general ledger. The next two columns will include your credit and debit balances.

You'll record your credit balances in the center column (the credit column), while your debit balances are recorded in the far right column (the debit column). The total debit and credit balances will appear at the bottom of the columns.

When you prepare your trial balance, include as much detail as possible, such as the date of the accounting period. This information will help you stay organized if you need to refer to your previous trial balances.

Trial balance example

Here is what a trial balance might look like for Company X. The far left column will include the account names used in the company's accounting system:

In this example, the debits equal credits ($120,000 and $120,000), which suggests that the debit and credit entries are accurate.

Types of trial balances

Trial balances come in three different types:

- Unadjusted trial balance

- Adjusted trial balance

- Post-closing trial balance

Each trial balance will follow the same format as above, but they are used in slightly different circumstances.

What is an unadjusted trial balance?

An unadjusted trial balance is done before adjusting journal entries are completed. This is a quick spot-check that records transactions. You can use this trial balance as a starting point to analyze your accounts before adjusting your journal entries.

What is an adjusted trial balance?

You can perform an adjusted trial balance once your book is balanced. This type of trial balance contains the final balances in all company accounts, and you can use it to prepare your official financial statements.

What is a post-closing trial balance?

A post-closing trial balance contains data on your total entries for the year. The post-closing trial balance thus becomes your starting trial balance for the next fiscal year.

Limits of a trial balance

While a trial balance can provide a helpful snapshot of your financial position, it's not a foolproof method of preventing all possible mistakes. Even if your debit and credit entries add up to zero, passing the mathematical proof test, that doesn't mean they are correct.

These are some common examples of errors that can creep into your records without being detected by your trial balance:

- Duplication error: Transactions are recorded more than once

- Omissions: Transactions haven't been recorded in the books

- Errors of reversal: Transactions are recorded backward (credit and debit entries are flipped)

- Compensating error: Transactions contain two errors that happen to match

- Data entry errors: Transactions are recorded in the wrong account or as the wrong amount

Limitations aside, a trial balance can still be a valuable tool for evaluating your company's finances, and it can be helpful when you examine your company's financial statements.

How to prepare a trial balance

Preparing a trial balance is simple once you know the steps. Here's how you can complete a trial balance of your own.

1. Calculate the account balances for your ledger accounts

Your business transactions are initially recorded in your general ledger. Each transaction will receive its own journal entry connected to the corresponding account name.

Depending on your accounting system, you may need to combine multiple expenses and sources of income. For example, your accounts payable account may contain multiple smaller entries, which you'll need to total before transferring this data to your trial balance.

You'll also need to close each balance to ensure that you focus on a specific time — usually, the duration of your accounting cycle, whether monthly or quarterly. It's also possible to look at your balance for a shorter period.

2. Record credit and debit balances on your trial balance

Next, you'll transfer the closing balances from your ledger to your trial balance. Make sure that the accounts listed on your trial balance are the same as on your general ledger.

You'll record the total credit amounts in the left column (i.e., the column immediately to the right of your account names) and your total debit balance in the column on the far right.

Be careful! This is where you can make the mistake of recording items in the wrong column or even the wrong account. This will significantly alter the accuracy of your completed trial balance and cost you valuable time chasing down your mistake.

3. Calculate the total in your credit column

Calculate your total credits. If you've followed the above method, you can simply and quickly calculate all of the credit balances in your credit entry column. If you're preparing your trial balance with a spreadsheet software program like Microsoft Excel, you can insert a formula that will perform the calculation for you.

4. Calculate the total in your debit column

Perform the same calculation for your debit column. Again, this is simply a sum of all the debits of your accounts for that period.

5. Compare your debit and credit totals

Look at your completed totals. Ideally, your credit and debit balances should be identical. This indicates your books are correctly balanced. If you get two different numbers, don't panic. Finding discrepancies like this is why you created a trial balance, and discovering the error now can save you time and headaches later on.

6. Look for errors

You'll need to discover why when your numbers don't add up. First, check the trial balance for the most common errors. This check might reveal a basic manual data entry mistake or entries made in the wrong column or account.

Once you discover your error, repeat steps three through five to see whether your numbers now match. Repeat this process as necessary until you get matching totals.

7. Close your trial balance

Once you complete the process, you can close your trial balance. Save the document itself, which can be helpful if you need to perform the process again for a longer period.

Again, if you create your trial balances using spreadsheet software, you can save time by keeping a template that includes the basic mathematical formulas.

How to avoid trial balance errors

What happens if your trial balances consistently reveal errors and problems in your financial statements? It could be that your company needs a hand to improve accounting accuracy. Here are some tips for increasing the accuracy of your financial records.

Invest in accounting software

The right accounting or invoicing platform can minimize errors caused by manual data entry. Advanced AI can even pull financial data straight from your invoices and other documents, and this automation increases your efficiency while boosting your overall accuracy.

Create trial balances regularly

Common bookkeeping mistakes, like mistracking a cash account for forgetting to update the accounts receivable balance with a paid invoice, happen to everyone.

The more often you create trial balances, the greater your chances of catching these small errors before they snowball into significant problems. Create a trial balance at least once per quarter or reporting period.

If you're having consistent issues, consider preparing more frequent trial balances until you find the source of these anomalies.

Streamline information flow

Accounting data can become easily transposed when information is flowing in from multiple sources and departments. An electronic system can help you collaborate better so that your data stays organized and all in the same place.

It can prevent errors from duplicate entries or from placing certain debits and credits or closing entries in the wrong accounts.

Automate your financial processes

Managing your financial processes can be challenging, especially if you're the owner of a small to mid-size business. BILL can help. Our state-of-the-art platform can help you automate your core processes to improve accuracy and efficiency — and even increase your bandwidth to help you scale your business.

BILL integrates with today's best accounting software systems while providing innovative solutions for today's top-performing industries.