Invoice capture is one of the most critical steps of the accounts payable process.

Not only is it the first thing you do when you receive an invoice, but if done incorrectly, the problems will carry over throughout your entire invoice processing workflow.

Luckily, there are ways to minimize errors while capturing invoices and ensure that you’re paying the right people the correct amount of money on time.

In this guide we’ll dive into what invoice capture is, the steps involved, and how to avoid costly mistakes that can derail your AP process.

What is invoice capture?

Invoice capture is the process of extracting data from invoices, such as vendor names, invoice numbers, dates, amounts, and other information, and converting it into digital data that can be easily processed and integrated into your accounting or financial systems.

Let’s simplify that even more.

You receive an invoice in the mail from a landscaping company that maintains your office grounds. The invoice includes:

- The company’s name and contract information

- The invoice due date

- Invoice number

- Line items of each service provided

You need to keep track of this invoice for your records, and also have a way to process it to be paid. So you “capture” the invoice by inputting all the details from that invoice into your financial system.

The problem with traditional invoice capture

For a long time, recording invoices was a manual process as described in the above example. You would receive an invoice, and manually enter all the data into your financial system.

Even when you’re only dealing with a dozen or so invoices per month, it’s a time consuming and tedious task with plenty of room for error.

Now, imagine what this process looks like for companies that process hundreds of invoices per month from various vendors.

Plus consider the fact that invoices are sent through a variety of methods. You might receive some by physical mail, email, invoicing software, or even fax (nearly half of invoices are still sent by fax)!

All of these factors make the process more complicated and increase the risk for errors. Complications and errors lead to late payments, fees, and ruined vendor relationships—which ultimately hurts your business.

How do you avoid these problems?

Three words—automated invoice capture!

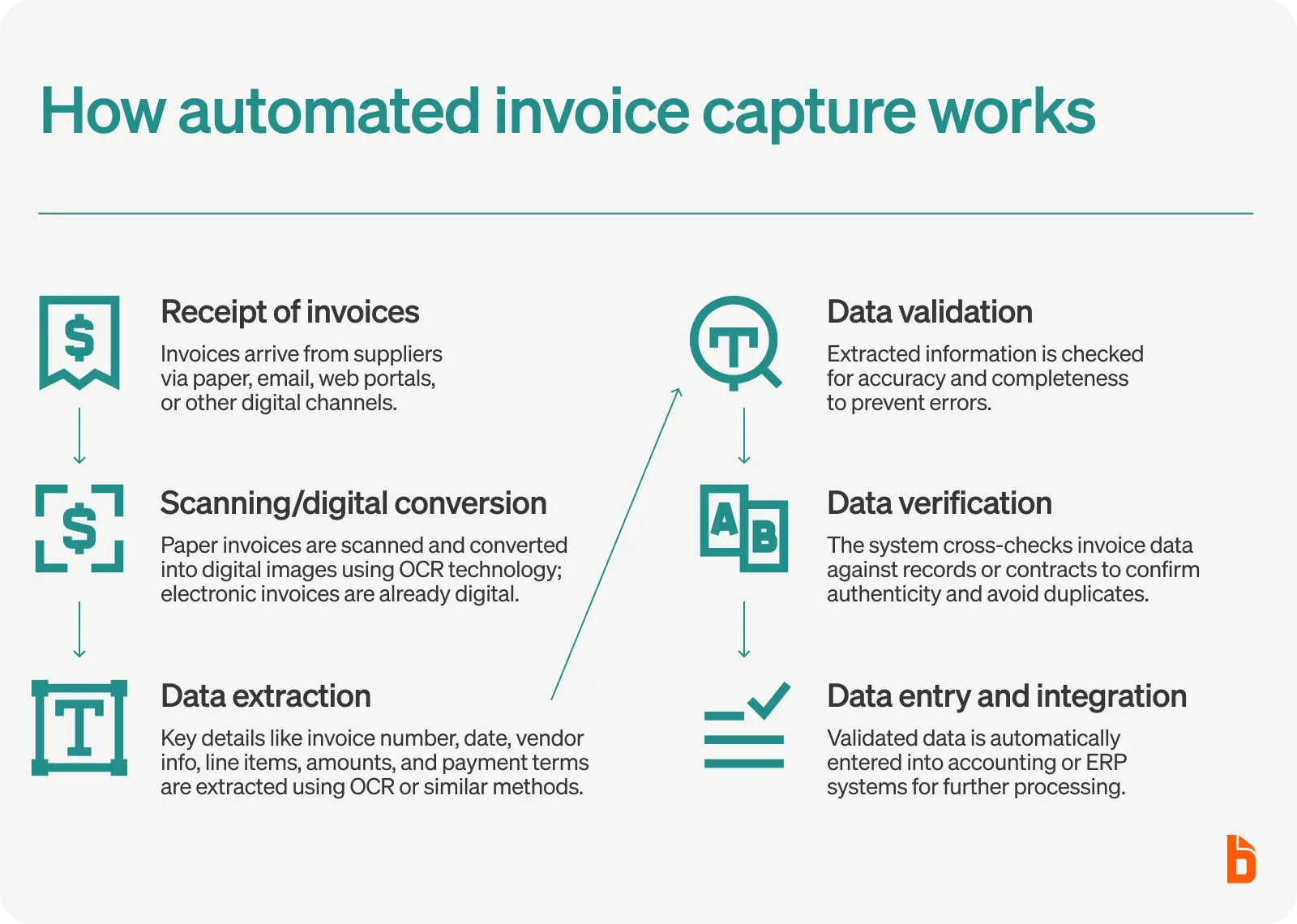

How automated invoice capture works

Automated invoice capture takes many of the steps that would normally be handled manually and uses a combination of AI and other technologies to do them instead.

Here’s how it works:

- Receipt of Invoices: Invoices are received from suppliers, vendors, or service providers either in physical paper form or electronically via email, web portals, or other digital channels.

- Scanning or Digital Conversion: If invoices are in paper format, they are scanned or converted into digital images using OCR (Optical Character Recognition) technology. Electronic invoices will already be in digital format.

- Data Extraction: OCR or other data extraction methods are then used to extract key information from the invoice, such as invoice number, date, vendor details, line items, amounts, and payment terms.

- Data Validation: The extracted data is validated for accuracy and completeness to ensure that there are no errors or discrepancies in the information.

- Data Verification: The system may cross-reference the extracted data with existing records or databases to verify the authenticity of the invoice and ensure it matches purchase orders or contracts and to avoid paying a duplicate invoice.

- Data Entry and Integration: The captured and validated data is entered into the organization's accounting or ERP (Enterprise Resource Planning) software, integrating it into the financial system for processing.

Other solutions for invoice data capture

While we mentioned OCR, it’s not the only solution for invoice data capture.

Here are some of the most popular options:

- Optical Character Recognition (OCR) Technology: OCR technology is widely used to extract text and data from scanned or digital invoices. OCR software can recognize and convert printed or handwritten text into machine-readable data, which can then be imported into accounting or invoicing systems. OCR technology significantly reduces the need for manual data entry and minimizes errors.

- Invoice Scanning and Imaging Software: Invoice scanning and imaging software allows businesses to convert paper invoices into digital formats. These solutions often integrate with OCR technology to automatically extract relevant data from scanned invoices. By digitizing invoices, companies can reduce the risk of losing or misplacing physical documents and streamline the entire invoice processing workflow.

- Electronic Data Interchange (EDI): EDI is a standardized method for exchanging business documents, including invoices, electronically between trading partners. EDI systems can automate the exchange of invoice data between companies, eliminating the need for manual data entry and reducing errors. EDI can be particularly beneficial for businesses that engage in frequent and large-scale invoicing.

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML technologies are increasingly being employed to improve invoice data capture accuracy and efficiency. These systems can learn from historical data and adapt to different vendors' unique invoice formats and structures. AI and ML algorithms can identify and extract relevant information, such as invoice amounts, due dates, and vendor details, with a high degree of accuracy.

- Vendor Portals and Self-Service Options: Encouraging vendors to submit invoices through online portals or self-service platforms can streamline the data capture process. Vendors can enter invoice data directly into the system, reducing the need for manual entry on the recipient's end. This approach also promotes transparency.

Invoice data capture solutions have evolved significantly, offering businesses a wide range of options to automate and streamline the invoicing process.

Implementing the right combination of these solutions can lead to improved accuracy, faster processing times, reduced manual effort, and, ultimately, cost savings if you choose to use them.

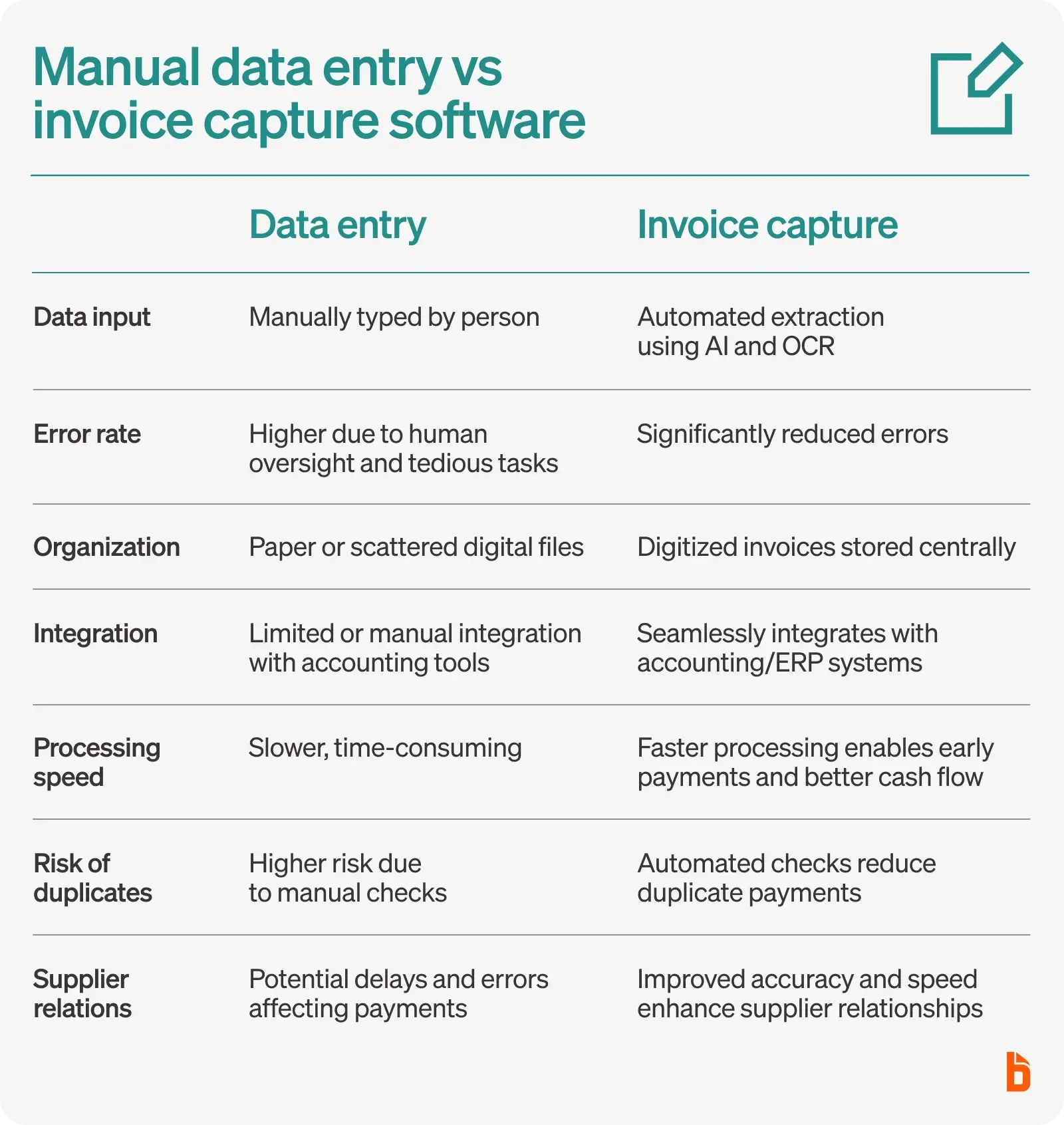

Manual data entry vs invoice capture software

As we mentioned above, some businesses still manually process invoices. They receive an invoice and manually type all of the data into spreadsheets or software.

If you’re in that group and are hesitant to switch to software, here’s a quick comparison between manual and automated invoice capture:

- Manual data entry requires a person to input invoice data, who can potentially overlook errors due to the tediousness of their task. In contrast, invoice capture software automates this process, drastically reducing errors and inefficiencies.

- Invoice capture software digitizes your invoices, allowing you to store them all in one place and stay more organized than relying on paper invoices.

- Automated systems can seamlessly integrate with existing accounting software, enhancing workflow and reducing the risk of duplicates being processed.

- Invoice capture software promotes faster invoice processing, leading to potential early payment discounts and improved supplier relationships.

How to switch to automated invoice capture software

Making a change to your business processes isn’t always simple.

Luckily automating invoice capture is fairly straightforward. However, there are some important steps to ensure a seamless transition.

The first step is selecting invoice capture software that supports a variety of invoice formats and has accurate invoice scanning capabilities.

The software should also be able to identify and process the same invoice in different formats, ensuring there are no duplicate entries. Implementing this feature can significantly reduce data entry errors and allow you to process invoices faster.

Next, the software should be integrated with your existing enterprise resource planning (ERP) system.

This integration is vital as it allows the seamless transfer of captured invoice data into the ERP system, ensuring that all data aligns and is easily accessible for further processing and analysis.

Once you choose and set up your invoice capture system, you’ll need to make sure your team knows how to use it. The easier it is for your team to adopt, the higher likelihood that they’ll use it regularly and correctly.

Lastly, continuous monitoring and timely system updates are crucial to ensuring that the automated invoice capture system remains efficient and relevant to evolving business needs.

If you’re still manually capturing invoices, you might want to consider BILL. From invoice capture to payment, BILL is a complete financial automation solution that can streamline your accounts payable processes.

Ready to automate invoice capture?

Automating invoice capture is a strategic move to streamline accounts payable processes. Its benefits — efficiency, accuracy, and time savings — cannot be understated.

If you want to revolutionize your financial processes with cutting-edge invoice capture technology, it's time to turn to BILL. Unleash the full potential of your accounts with our streamlined accounts receivable and payable automation.

Say goodbye to manual errors and hello to efficiency. Don’t let outdated practices hold your business back. Embrace the future with BILL’s accounts payable solutions.

Your business deserves the best – and with BILL, the best is what you'll get.